AFTER SPAC

SPAC, short for Special Purpose Acquisition Company, is a company form that has become increasingly popular in recent years. Essentially, a SPAC is a shell

CORPAI – Corporate Artificial Intelligence AI

Corporate artificial intelligence (AI) refers to the integration of AI technologies and applications into the corporate world. It’s a fast-growing area with the potential to

IPOs and Information Cascades

An Information cascade or informational cascade is a phenomenon described in behavioral economics and network theory in which a number of people make the same

The IPO Organizational Meeting

Once your company has convinced the managing underwriters for the offering and wants to begin the IPO process in earnest, an organizational meeting with management,

IPO Institute launches IPO Conference series in strategic alliance with DHMP Consulting.

Today in New York, the IPO Institute and DHMP consulting Partners LLC forged a strategic alliance to launch a regular series of regional conferences branded

What Is An IPO?

An IPO is an initial public offering. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the general public.

The Benefits of an Initial Public Offering

Marc Deschenaux is the founder and managing partner of Deschenaux, Hornblower & Partners LLP. Throughout an illustrious career, he has been involved in 169 IPO’s and more than 240 private offerings.

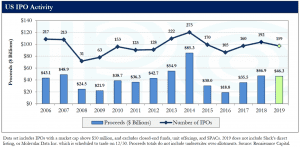

2019 IPO Market: Better Than the Headlines

The long-awaited debuts of mega unicorns Uber and Lyft were mega busts, capped off by WeWork’s kamikaze IPO attempt in September. But beyond these headline-grabbing

PRIVATE FINANCING

SHARES OF STOCK ISSUES: I. GENERAL RULES AND CLASSIC FINANCING METHODS An entrepreneur or a company is looking to raise capital to undertake a project.

IS YOUR COMPANY READY FOR AN I.P.O. INITIAL PUBLIC OFFERING?

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

HOW & WHY AN INITIAL PUBLIC OFFERING MAKES MONEY

Many entrepreneurs do not understand the reasons why the Initial Public Offering of a share of common stock (also known as “IPO “) makes money?

THE ROADSHOW

The Roadshow is a presentation organized by an issuer of securities and the syndicate of brokers and investment banks underwriting an issue of securities, aiming at presenting

INITIAL PUBLIC OFFERING (IPO)

I. PUBLIC OFFERINGS AND FLOATATIONS “Floatation” is a generic term that includes a significant number of complex procedures, which result in the securities of a

THE THEORY OF WAGONS APPLIED TO INITIAL PUBLIC OFFERINGS – IPOS

As discussed in my previous article “Is your company ready for an I.P.O. Initial Public Offering?”, the main barriers preventing an IPO to happen for

WAYS OF GOING PUBLIC TO THE STOCK MARKET

Comparison with Water Have you played with a waterspout in the garden when you were a kid ? If so, then you surely put your

INITIAL PUBLIC OFFERING – I.P.O. – IPO

The Initial Public Offering Definition The Initial Public Offering is the event defined as the first time that the shares of stock of a stock

IPO Valuation

The initial valuation of a stock of a company is critical to the success of an IPO. These initial valuations serve as the primary signals

IPO Allotment

IPO Allotment is a process where the “registrar to the offer” with the help of a lottery system finalize the process of allocating the IPO

Escrow Account

The Home information allows you to pull into the home page any information you want to bring to the attention of the visitor, right from

IPO Complexities

Here we should have a short description of the products that informs the potential buyer on what this is and how he or she can

Themes

IPO – Investment – Fees – Roadshow – Private Offering – Marketing – Legal – Taxation – Advisory

Books

Understanding the IPO by Marc Deschenaux