Initial Public Offering Definition

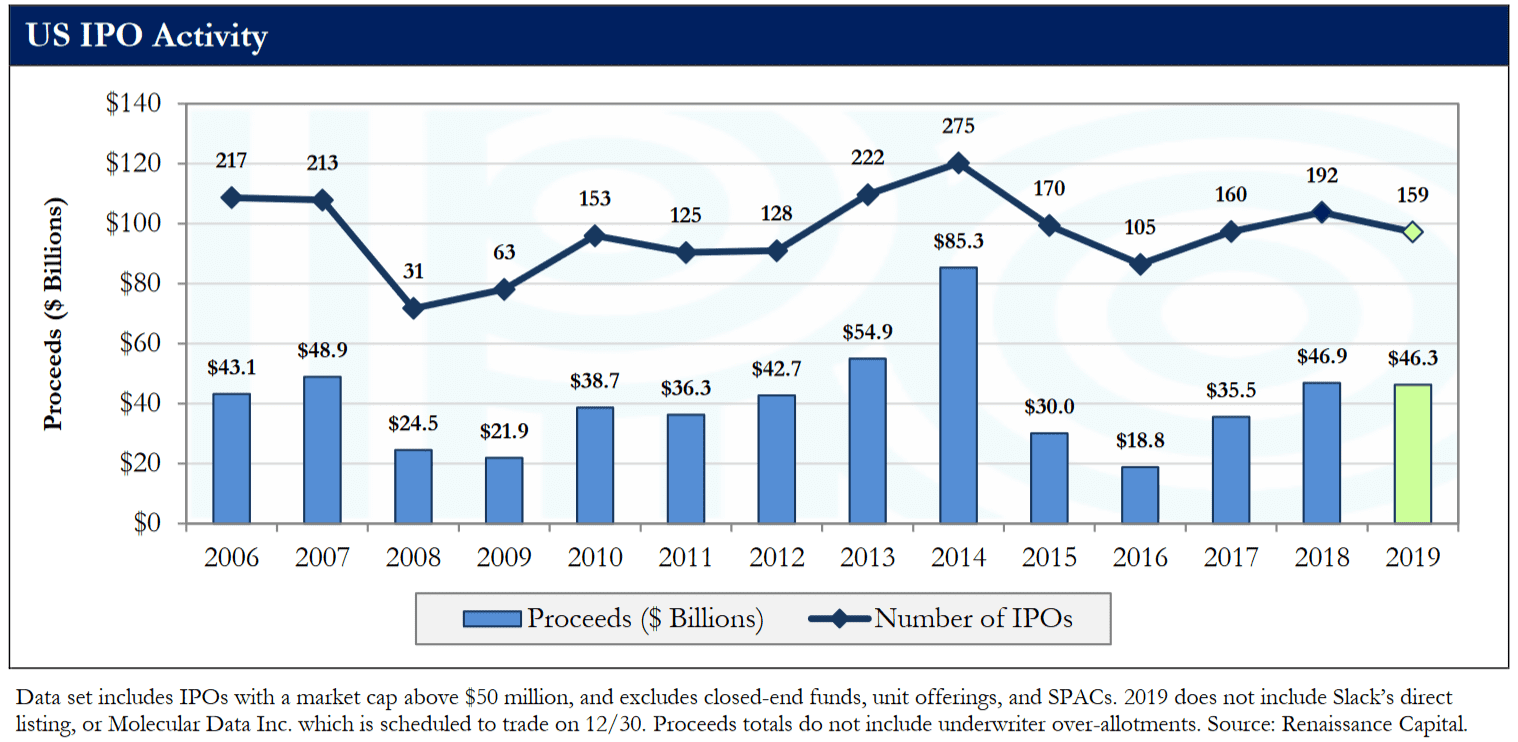

The Initial Public Offering is the event defined as the first time that the shares of capital of a stock issuing private company called the “Issuer”, are offered for sale to the public. The proceeds of the sale of the Issuer’s stock raise a large equity financing for said Issuer. IPOs are often issued by … Weiterlesen