Figure 13: Important elements of due diligence

Performing due diligence on potential investee companies is a crucial component of successful fund management, and funds should have a pre-determined process for this, a strategy they can begin to formulate alongside the development of their investment strategy. Due diligence is the first and only opportunity a fund has to gather the information it needs about potential investees to make an informed decision before investment. Due diligence has four core functions: (1) as a risk management tool, (2) as an opportunity to identify ways to add value to and improve the impact of an investee, (3) as a way to identify the social or environmental impact, or both, of the business, and (4) as a means to respond to LP expectations.

The due diligence process is not linear (Figure 19). A fund may carry out components of due diligence assessment in whatever order it chooses or perform them simultaneously. The fund should, however, remain consistent in its due diligence approach for all portfolio companies in order to respond effectively to LP feedback in a consistent and organized manner.

Due Diligence: Managing Risk

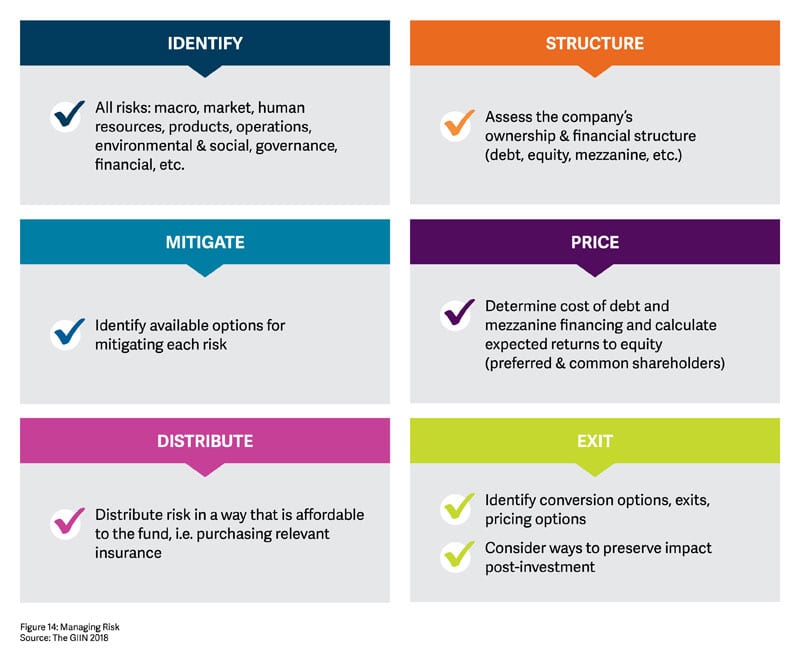

During due diligence, a fund can ask key questions of a potential portfolio company and surface potential risks. A fund must assess multiple aspects of risk for a pipeline company (Figure 14).

Figure 14: Managing risk

LPs invest through funds primarily to manage their risk and to add value to their underlying investments in portfolio companies. The fund’s role is to identify as many risks upfront as possible and then to mitigate these risks through the structure of the investment. Funds can design a standard due diligence questionnaire that tackles the various forms of risk.

Due Diligence: Adding Value

Adding value to a portfolio company begins during due diligence, as the process for identifying risks can also reveal potential opportunities for improved IRR. Similarly, during the risk management process, the fund manager can develop a strong relationship with the entrepreneur and begin its role as trusted advisor and consultant to the firm. The fund manager may also identify potentially beneficial roles for an expert consultant. Risk management strategies can also add value by enhancing the company’s reputation, transparency, or both.

Due Diligence: Screening for Impact

Experienced impact LPs expect funds to implement impact screening mechanisms during due diligence. Many investors use collected impact data to inform both investment and impact management decisions across their practice, as described above. Impact screening helps ensure accountability to a fund’s impact-oriented mission. Screening investee companies for impact helps fund managers to determine where to allocate their time building relationships with prospective investees. Some funds will create an ‘impact committee’ from their internal fund management team and LP network to screen potential investments. This process can minimize the impact risk of the fund’s pipeline and helps allocate the fund manager’s time and resources. The impact committee rejects enterprises that lack a strong social impact thesis, helping to ensure that impact remains an integral part of the fund’s investment decisions. Once a fund identifies a promising investee, it presents its business model and theory of change to the impact committee to demonstrate how the business aligns with the fund’s social impact goals. The committee then reviews scenarios of business growth, risks, projected impact, and potential challenges. The impact committee and fund manager discuss the prospective investment to address uncertainties around impact assumptions. If the investment has sufficient potential for impact, it then proceeds to financial due diligence.

Due Diligence: Investor Expectations

A fund’s approach to due diligence is an important test for LPs that signals the professional quality of the fund’s practice. Investors particularly look for funds with coherent policies and procedures for due diligence that are used consistently throughout the deal sourcing process. Such an approach demonstrates that a fund understands the unique industry, market, and operations in which the fund is trying to invest and that it can adequately manage, identify, and mitigate potential risks, including any governance, reputational, or environmental issues.

ADDITIONAL RESOURCES:

- Social & Environmental Due Diligence: From the Impact Case to the Business Case, Root Capital

- The resources below have been developed by the GIIN to help you integrate impact considerations into your investment management:

- Set goals and expectations: The GIIN has coordinated with a variety of stakeholders through The Impact Management Project, facilitated by Bridges+, to identify shared fundamentals for understanding impact and more clearly articulating goals and expectations.

- Define impact strategies and search for evidence: The GIIN’s Navigating Impact project provides a simple means to align impact goals and expectations to credible, evidence-backed investment strategies – such as those targeting housing, clean energy, or smallholder agriculture – and use metrics that indicate performance toward their goals.

- Select metrics and set targets: IRIS is the GIIN’s catalog of generally accepted performance metrics that the majority of leading impact investors use to measure and manage social, environmental, and financial performance and evaluate deals. The GIIN manages IRIS, and offers it as a free public good to support transparency, credibility, and accountability in impact measurement & management practices across the impact investment industry.

- Measure, track, use the data, and report: The Impact Toolkit is a digital database designed to help impact investors identify otherwise fragmented supporting resources across the web that are fit-for-purpose to one’s impact measurement and management (IMM) needs.